Financial Inclusion Solution

Driven by the challenge of bringing financial services to the over 500 million unbanked households outside urban and peri-urban areas, SourceTrace offers robust, proven remote financial transaction software that utilizes mobile phones, point-of-sale devices and other wireless handsets over existing networks. SourceTrace has partnered with financial services organizations throughout Asia, Latin America and Africa to help banks fulfill financial inclusion laws and serve vast new markets — without the expense of opening new branches.

Benefits

With the SourceTrace DATAGREEN (DG) Financial Inclusion solution, organizations achieve:

- Global visibility of operations

- Greater transparency

- Real-time business intelligence

- Reduced operational costs

- Increased internal controls

- Better resource management

- Increased capacity to grow

Modules overview

The SourceTrace DATAGREEN (DG) Financial Inclusion solution is designed specifically for the financial market and business processes. The core modules of DATAGREEN (DG) Financial Inclusion solution are:

DATAGREEN (DG) Remote for Financial Inclusion modules

- Customer Enrollment

The “Customer Enrollment” module enables your business to capture information directly on the field.

- Provides a unified and up-to-date customer database

- GPS technology and photos trace the location of the customer at enrollment time

- Captures KYC data and fingerprint biometrics

- SmartCard issuing on the field

2. Apply for Financial products

“Apply for financial products” module enables the efficient data capture for financial product request, such as micro loans, micro insurance, savings accounts and other products.

- Capture data at the source and send it for back office processing

- Receive customer request approval or denial on the field

- Issue new financial products on the field

3. Deposit and Withdrawl

“Deposit and Withdrawal” module enables the remote Field Agent to securely receive and disburse money.

- Securely identify the client using biometric authentication

- Receive savings deposits

- Allow th client to Withdraw money from his saving account

- Printout account balance and mini-statements

4. Micro-loans and Micro-Insurance

“Micro Loan and Micro Insurance” module allows the clients to access special financial products for their needs. Field Agents can offer different kinds of micro insurance products as well as production micro loans.

- Issue micro loans and micro insurance

- Collect micro insurance premium payments

- Collect micro loans repayments

- Printout micro insurance policy

- Printout micro loan payment schedule

5. Remittance and Payments

“Remittances and Payments” module is the perfect way to offer 3rd party services such as airtime recharge, bill collection, international money transfer, public services bill collection, tax collection among others.

- Attract more clients by offering a bigger portfolio of transactions

- Earn extra income by collecting 3rd party providers

- Increase the client loyalty

6. Domestic Money Transfer

“Domestic Money transfer” module allows the clients to send money between other accounts and to unbanked persons

- Transfer money between bank accounts

- Send money to an unbanked person

- Collect money while the mobile Field Agent is visiting the village

- Collect the money at Business Correspondent store

DATAGREEN (DG) Server for Financial Inclusion modules

- Business and Reporting

Access to insightful business reports on a single client level or at a group, regional or global level of:

- Client profile data and account status

- Deposit and Withdrawal transactions

- Micro Loans and Micro Insurance transactions

- Account and other products approval and denial

- 3rd party transaction processing

- Commissions earned by Field Agent and Business Correspondent

2. Remote App management

Manage the DATAGREEN (DG) Remote application from a central location and publish updates over-the-air.

- Reduce the operational and IT costs

- Schedule updates based on your business requirements

- Increase the service availability and reduce downtimes

3. Device and Field Management

Manage remote Agents and Device using a centralized Web application.

- Create, enable and disable devices

- Create, enable and disable Agents

- Assign credentials and link Agents to mobile devices

4. Correspondent data management

Access to the Correspondent profile data and update the information using the Web application.

- Create and update Correspondent profiles in the database

- Keep up-to-date the information about all the correspondent

- Visualize Correspondent location on a digital map

5. Executive Dashboard

The Executive Dashboard present real time information of key business indicators in graphical charts.

- Understand the operations and compare it against previous and forecasted data

- Visualise “Top ten” charts, including most busy Correspondents, volume and amount per Correspondent and other data views

6. Digital Mapping

Visualize georeferenced transactions and data to get a completely new view of the business.

CarbonTrace

Data is the biggest challenge when it comes to connecting farmers with carbon markets. SourceTrace brings experience of nearly a decade in building solutions to meet the data gap in agriculture to carbon farming.

Our solution, CarbonTrace, helps organisations solve the data challenge in carbon farming. CarbonTrace has the unique distinction of being useful for large farms as well as small farm holdings. By aggregating small farmers, our goal is to include them in the sustainability network and passing the benefits of carbon sequestration down to the smallest contributors.

Bring all stakeholders on one platform

Bring all stakeholders on one platform

Farmers, inspectors, traders, funders and more

Capture verifiable data from the ground at every stage

Combination of ground and satellite data to leave no gaps

Transparent and auditable program management

Farmer contracts, payments, credit generation - all verifiable

Easy impact assessment to build scalable programs

Helps build scale by meeting concerns and requirements

carbonTrace meets the

data gap

Track every improvement in growth practices at the farm level:

• Fertilizer application and tillage

• Water management

• Residue management

• Cash crop and cover crop planting and harvest

• Grazing and livestock management practices

Who needs CarbonTrace

Agri-food Corporations

Looking to make carbon footprint calculation a part of your sustainability goals? We can help.

Carbon farming technology companies

If you are building a calculator but don’t have ways to verify ground data, you need us.

Sustainability funds and Governments

Need a platform to bring transparency & co-ordination in a multi-stakeholder project? That’s us.

CARBONTRACE – STAKEHOLDER MAP

Why CarbonTrace

Makes agriculture future ready

Reduces agriculture’s carbon footprint, making it competitive

Verifiable benefit transfers

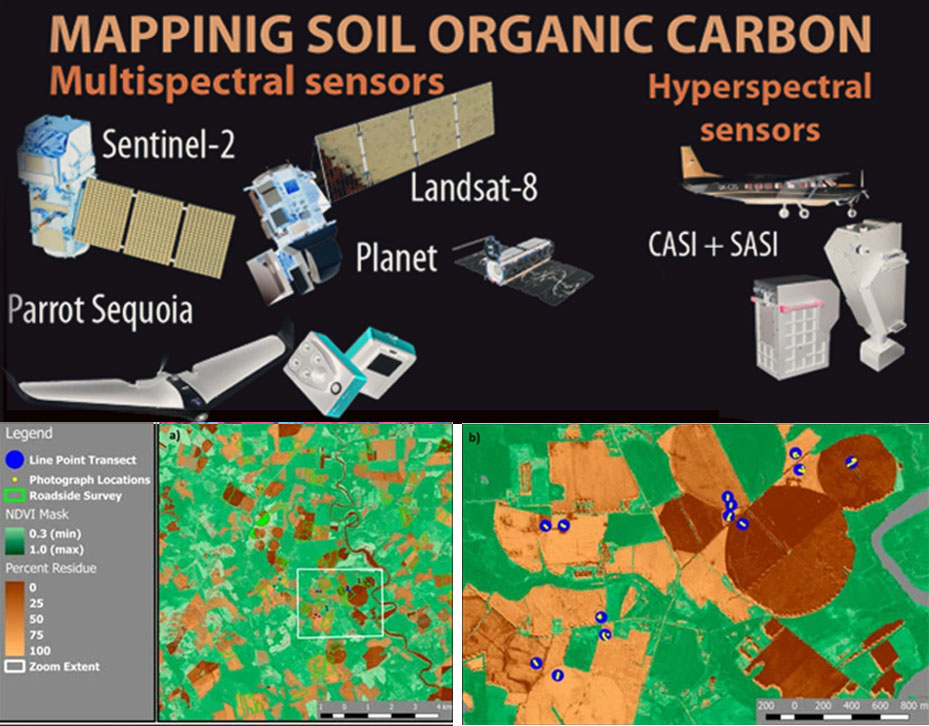

Satellite based Soil Organic Carbon Storage Monitoring

SourceTrace uses data from Sentinel and Landsat satellite imagery to bring ease and accuracy into carbon storage estimations. The automated processing chain was developed to process the multi-sensor satellite imagery and derive meaningful information at farm level.

Our satellite data combined with verified data from the ground enable you to see the entire picture of conservation practice adoption, for example tillage and crop residue burning etc.